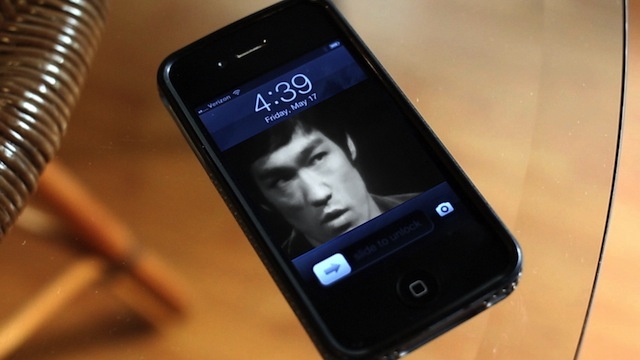

“Now water can flow, or it can crash.

Be water, my friend…”

– Bruce Lee, speaking on The Pierre Berton Show, 9 December 1971, video excerpt from Hito Steyerl’s Liquidity Inc. (2014)

This autumn marks a decade since the beginning of the global financial crisis, the ‘credit crunch’ that started in the US subprime mortgage market and spread to the global banking sector, pushing the world’s economies into recession and, for many people, ushering in a period marked by austerity in public spending, downward pressure on wages and rising job insecurity.

And yet, in those same years the art market has been doing pretty well. Take a look at UBS and Art Basel’s report The Art Market 2017 and you find that global art-market sales over the postcrash decade barely noticed the ‘age of austerity’. After taking a dive in 2009 in the immediate aftermath of the financial crisis, annual global art sales had soared to $68.2 billion by 2014, surpassing their precrash 2007 peak of $65.9b.

Unsurprisingly, the decade since the financial crisis has been marked by increasingly angry debates about how the artworld is implicated in the machinations of a global economy, and in the interests of the ‘1 percent’ – the global elite of the ultrawealthy who now seem to pay such close attention – and commit so much of their disposable cash – to contemporary art. As the advanced economies have stumbled along through the 2010s, much ink has been spilled over the growing disparity between the wealthy and everyone else, and a new set of terms has entered our vocabulary to describe the experience of economic and social life in the post-financial-crisis era. It’s the age of the ‘gig economy’, of zero-hours contracts and of precarious labour; the age of lifelong student debt; of urban gentrification and dwindling home ownership and stagnating real wages.

The commercial artworld, however, saw the same period through the lens of ever-increasing sums paid for art objects. Just as the global financial services giant Lehman Brothers filed for bankruptcy on the morning of 15 September 2008, Damien Hirst opened a two-day public auction of his work at Sotheby’s in London. It made over £110m. The following years have seen records continuously broken. In 2013 Jeff Koons’s Balloon Dog (Orange) (1994–2000) sold for $58.4m, then the most expensive single work by a living artist ever hammered down at auction. In May this year, Jean-Michel Basquiat’s painting Untitled (1982) became the most expensive work by an American artist, selling for $110.5m at Sotheby’s New York.

The extreme visibility of the auction market, and the hype that surrounds each latest record price, tends to provoke reactions of moral outrage and dismay at how much the ultrarich are prepared to pay for artworks. But what’s less often asked is how, given the shaky state of our economies, the very wealthy have come to have this wealth to dispose of, and more importantly, why they should want to put it into artworks, of all things. Moralistic criticism is easy to come up with, but it doesn’t ask questions of the nature of post-financial-crisis economic life.

If one steps back from the narrower fortunes of the art market, however, and takes a look at the bigger economic story, one starts to understand the peculiar character of the decade since the financial crisis. In a recent article in the New Statesman titled ‘How the world’s greatest financial experiment enriched the rich’, the financial writer Christopher Thompson discusses the impact of a decade of ‘quantitative easing’, the monetary policy employed by central banks since the crash to pump vast quantities of invented money into the world financial system, in the hope of kickstarting economic recovery. As he explains, in a little under a decade, central banks ‘in the US, Europe, the UK and Japan have inundated financial markets with more than $8trn using a system dubbed “quantitative easing” (QE). This equates to around $10,000 per man, woman and child in the countries whose currencies they guard.’

QE’s process is circuitous and its effects are not straightforward to explain, but as Thompson summarises, central banks don’t just ‘print money’, ‘they do it by buying bonds, most of them issued by governments, from financial institutions such as pension funds and insurance companies, which hold them as investments’. In other words, government central banks generate electronic cash with which to buy back government debt (bonds) from corporate investors. This has had two big effects. The first is that interest rates have fallen; since there is more money around, it has become cheaper to borrow it, with central bank rates near or even below zero. The other consequence, since QE has increased the market value of bonds, and investors have sold their bonds, that money has gone elsewhere. As Thompson puts it, ‘financiers have used the new-found money to go shopping, all at the same time. Suddenly, demand for assets significantly exceeds supply. This pushes up the value of investment assets – including shares, which have surged to record highs despite weak economic growth, and bonds, and also fine art, London property and vintage Château Lafite.’

Property, wine and art. What’s significant about Thompson’s rollcall of asset types is that they produce nothing in themselves and are characterised by their scarcity. In ‘global cities’ like London, the property market has surged throughout the postcrisis decade, with average prices almost doubling between 2009 and 2017, according to the government’s own index.

Why would the very wealthy want to put their money into artworks, of all things?

But if scarce things produce nothing, why do the wealthy buy them? As art market commentators have noted in the last few year years, one of the biggest trends in the commercial gallery market has been the polarisation of the gallery system, with the biggest galleries doing well while ‘midlist’ and emerging galleries shrink back; and at auction, the rising prices for individual artworks is a symptom of the concentration of value in more expensive works. As The Art Market 2017 records, from around 2012 onwards, the fastest growing segment of artworks sold at auction were those priced above $5m.

The concentration of value in artworks at auction and the tilting of commercial power towards the ‘blue-chip’, upper end of the gallery system shows how much artworks have become a ‘refuge’ for liquidity looking for security. The world is awash with cash, but this liquidity does not, as Thompson notes, seem to be making much of a difference to economic growth.

What Thompson skims over, though, is that one big issue – of economic growth. While stock markets have surged, and corporate profits have done well, growth in the G7 advanced economies has weakened even further in the decade since the financial crisis. According to the IMF, GDP in the G7 has grown by barely 2 percent annually since 2010. The 2000s managed only a little better, and these decades compare poorly with the 90s, when growth was often around 3 percent; even in the strife-ridden 1980s it was often over 4 percent.

This decline in growth over recent decades is dealt with in more depth by economist Phil Mullan, in his book Creative Destruction: how to start an economic renaissance (2017). As Mullan argues, the causes of slowing growth and growing financialisation lie in the slowdown of investment in new, more productive economic capacity, and the tendency for older, less productive industries and businesses to survive, rather than go bankrupt and be replaced by more productive competitors. The blunt assertion of Creative Destruction is that while each recession of the past 50 years has been less severe, subsequent recoveries have also been weaker. Investment in making the economy more productive has declined, while corporate profits and cash reserves have grown, in what Mullan terms the rise of the ‘zombie economy’ – an assessment borne out by the current postcrash ‘jobless recovery’, marked by historically low growth, rising debt (financed by the new wave of liquidity) and further declining productivity.

In other words, however much liquidity there appears to be, however much ‘value’ it seems to represent, it’s not being invested in revitalising the real economy. Economic growth is what makes societies in general better off, and the absence of tangible growth is what makes the postcrisis decade different to those that came before.

One way or the other, these are all symptoms of the boom in assets in a time of economic stagnation

But if the tide of liquidity isn’t going into investing in R&D or new infrastructure or better manufacturing, it has to find somewhere to go, and it is going into art. It’s not just going into single artworks bought in galleries or at auctions, of course. Increasingly, it’s going into the building of museums and private foundations set up by individuals, and the financing of new wings of public galleries and more. One way or the other, these are all symptoms of the boom in assets in a time of economic stagnation.

In Hito Steyerl’s jovial and uncanny video Liquidity Inc. (2014) the motif of water, weather, globalisation and liquidity are twisted together into a kind of allusive visual poem about the chaotic forces of the global economy. A young Vietnamese American, Jacob Wood, a financial broker made redundant in the wake of the Lehman Brothers collapse, is seen working out and competing in a US mixed martial arts tournament. His story (he came to the US as a child refugee) is interrupted by surreal scenes of computer-generated water, hurricanes and storms, and a masked weather presenter who suggests that you ask such questions as: ‘How did this gust arrive here? Where did it come from and who am I to be blown by it?’ Steyerl’s hallucinatory narrative pitches individuals into a world of endless seas, with no visible means of support, buffeted by an economic ‘atmosphere’ that exists independently of them, and which they are powerless to influence or control.

Liquidity Inc. is an ode to the postcrisis decade, in which the real economy has become a hallucination, and all that appears is a sea of numbers, in an everyday world in which everything, from rent to art, is only getting more expensive, and in which even art objects are not rare enough to absorb the flood of liquidity unleashed in the wake of the last crash.

But if liquidity is a tide, some indications suggest that it may be turning away from art. After reaching new heights in 2014, The Art Market 2017 reports that art sales declined to $62.8b in 2015 and then $56.6b in 2016. The biggest contributor to that fall was the big drop in sales of art at auction, which shrank by 26 percent between 2015 and 2016 (from $29.9b to $22.1b), and within auction sales, the biggest decline was in those high-ticket $10m-plus artworks. Other indicators of a cooling in the auction market include a rise in lots not achieving their reserve price and in works selling below their estimate.

The stuttering auction market’s focus on high-price items is a spectacularly public display of vast wealth condensed into rare objects. But the dealer-led primary-sales market has also seen a concentration of value in higher-priced works. And in the secondary market – those dealers who trade in works that have previously been bought and sold – median prices have increased substantially between 2015 and 2016. All these tendencies suggest a tightening of supply of artworks, as collectors look to a narrower range of artworks whose future value is more assured.

In those circumstances, liquidity may start to flow elsewhere, into even more exotic forms of assets, as demand for other older assets grows and their prices rise. One of those seems to be cryptocurrency – as I write, the first cryptocurrency, bitcoin, has seen a massive rise in its market value. At the start of 2017 it was trading around $750. In October its price soared to over $5,000. Investment funds are piling in.

The art market has started to take note of this strange new type of asset-currency, and financial entrepreneurs have seen an opportunity to fuse the art market with cryptocurrency. This summer saw the launch of Maecenas, a cryptocurrency based art-trading platform, which offers investors the possibility of buying into shares of high-value artworks, rather than buying and selling individual works. Actually, they’re not exactly shares, but asset-backed certificates: the owner of a work retains ownership, raising money by auctioning these certificates, which can then be traded on Maecenas’s own trading platform. The promise is of a more ‘liquid’ and transparent market, in which the value of an artwork will be set by a market of multiple buyers. The prospect, of course, is that the ‘value’ of individual artworks will rise as investors who don’t have $50m to buy a whole Jeff Koons start buying into parts of a Koons, or square centimetres of a Gerhardt Richter painting. Hidden in secure vaults, artworks won’t have to be traded between billionaires, but instead fractionalised by smaller investors, all buying into the promise of rising prices.

Beyond the hype of such a scheme, one can detect the prospect of yet another asset bubble, as investors scramble to find ways to put their wealth into assets that promise guaranteed growth. Meanwhile, in the real world, real growth, as measured by how much is produced in a given period of working time – productivity – continues to stall. As Mullan points out in Creative Destruction, investment in R&D and capital investment across the developed economies continues to wane. The tide of liquidity that has washed into the art market should be understood, not in moralistic soundbites about the greed of the ‘1 percent’, but as the long-term failure of our capitalist economies to produce more wealth for everyone. Producing more, however, is itself controversial today, at a time when radicals prefer to insist that we already have ‘too much’, and are more at home talking about ‘de-growth’ than about prosperity.

And yet, if there’s no renewed debate about what prosperity means and society’s ability and willingness to renew economic growth, the real economy will continue to stagnate, while being subject to increasingly extreme flows and crashes of finance and fictitious capital.

In Steyerl’s video, nothing solid is visible, only an endless sea of liquidity, with nothing on the horizon.

From the November 2017 Power 100 issue of ArtReview