The explosive arrival of the nonfungible token is giving contemporary art’s elders the shivers

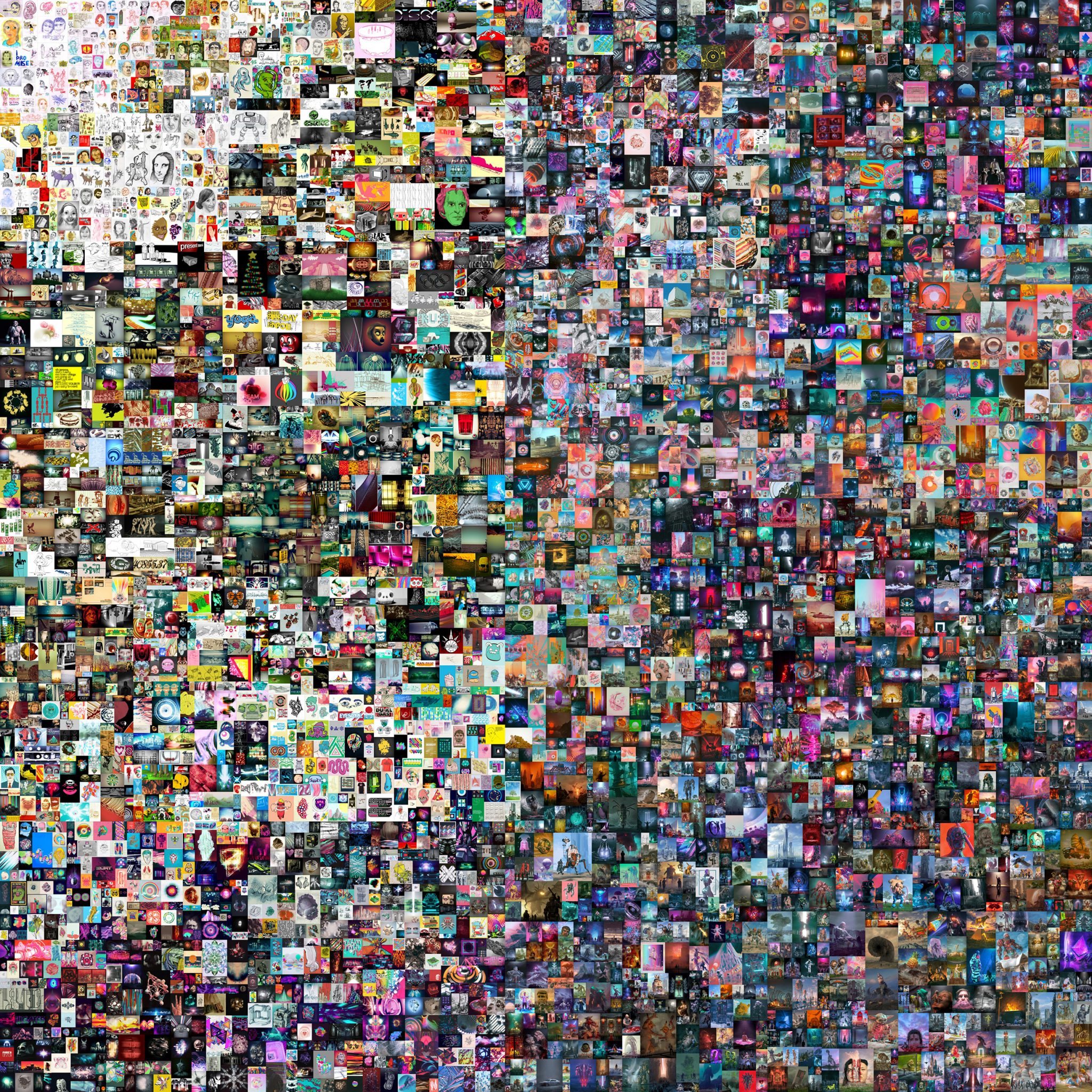

Money is a great way to concentrate human attention. As I write, a large jpeg, albeit one made up of 5,000 individual jpegs, has been auctioned by Christie’s for $69,346,250. This is EVERYDAYS: THE FIRST 5000 DAYS (2007–20), by videomaker, illustrator and, now, feted artist Beeple – otherwise known as Mike Winkelmann. Winkelmann first shot to fame (or at least to mainstream artworld attention, since he had many nonartworld fans and Instagram followers already) following the auction of a collection of his ‘everydays’ – surrealistic, sometimes comic, often boorishly zeitgeisty CGI images that Winkelmann has been producing and posting once a day, every day, since 1 May 2007 at an online auction last December. Run through the online platform Nifty, Beeple’s sale rang up $3.5 million. But now that he’s hit the upper echelons of art retail, that seems like peanuts.

Beeple’s shock success follows an explosion of interest in the market for collectible art that has opened up around nonfungible tokens (NFTs) – blockchain and cryptocurrency’s answer to the unique art object. Through NFT trading platforms like Nifty and Super Rare, artistic hopefuls are able to sell artworks backed by what are, effectively, tradable digital editioning rights. Technically, pretty much anything digital can be bought and sold as such a ‘tokenised’ NFT asset, and in recent weeks, all manner of digital artefacts have made headlines; a gif of Nyan Cat, the annoying 8-bit retro flying cat, sold for $588,000 (in cryptocurrency equivalent); Twitter founder Jack Dorsey is auctioning the first ever tweet (‘just setting up my twttr’), with bids currently standing at $2.5m; while synthpop star (and tech oligarch Elon Musk’s partner) Grimes sold a collection of digital images and CGI videos for $5.8m.

The artworld is torn by the spectacle of these pop-cultural baubles suddenly transforming what had until now been considered aesthetically thin air into millions. The commercial artworld, battered by a year of COVID-19 disruptions and preoccupied with how to monetise art objects that are hard to show and sell (more so in an era of shuttered galleries and art fairs), has found itself forced to turn to the digital world to maintain the visibility of its wares. Yet countless video programmes, online art-fairs and viewing rooms have not really cracked the serious problems facing a global artworld that is grounded until further notice. And the flaring up of NFTs presents a seductive solution to two key art-market issues: it offers the promised land of a secure, yet very liquid medium of financial exchange, coupled with an inviolable guarantee of uniqueness and scarcity for the objects traded through it. Savvy auctioneers like Christie’s, of course, jumped in when they spotted an opportunity (AKA money).

But the artworld’s critical conscience has been less enthusiastic; what are these cultural artefacts that now seem to have overtaken the attention of the media, of auctioneers and collectors with such ease? And with the market for collectible digital artefacts now invading the artworld, what does this mean for contemporary art’s commercial and institutional gatekeepers, and even art criticism? After all, to this critic, Beeple’s and Grimes’s images suck (and, to be fair, Beeple himself has described much of his imagery as ‘crap’). But we’ll come to that.

Some of the immediate critical responses to the NFT and Beeple craze are illuminating, because they suggest something of the doubt that now racks contemporary art’s understanding of its own cultural values and social role. As Martin Herbert perceptively notes, ‘such cultural moments are worth dwelling on, in part because they illuminate whether you have a gatekeeper mentality or not’. ‘The hard thing to determine’, Herbert goes on, ‘is whether you’re trying to maintain some perceived standard, or if you’ve become traditionalist, or if, more simply, you’re a snob.’

Herbert is no snob (full disclosure: we ArtReview people occasionally hang out), but the instinct to defend art against a kind of cultural incursion from the world of pop and the popular is a recurring motif in the critical coverage of NFT. In a fierce polemic against the rise of the meme culture that NFT has come to represent, Spike magazine’s Dean Kissick also notes that ‘the old gatekeepers have been losing their power for a while now’. For Kissick, as for Herbert, this is no good thing, since ‘much of today’s culture is a poor-quality remake of something better and more compelling’. Turning his fire on Beeple’s ‘images of images’, Kissick evokes the ‘collective-hallucinatory firmament in which tired art, recycled pop, bad taste, political spectacle, and hyper-speculation swirl and coalesce into modern life’.

Kissick hits on an important point: rounding on how the successes of pop-culture artists like KAWS and Beeple ‘lead a triumphant procession of popular things’, he notes that ‘as someone who grew up hating popular things, who turned to art as a child because I felt alienated by popular culture, my classmates, the country I was growing up in, society, and so forth, I can’t feel happy about that’.

For decades, and for many of ‘us’, contemporary art has presented itself as a kind of refuge from the apparent iniquities and stupidities of ‘popular culture’ – a place where counternormative values, politics and identities could stake a claim to a degree of cultural autonomy, somewhere we might argue over what makes good art, and even cultivate something like ‘taste’. Contemporary art shares space with counternormative subculture like indie music, independent film and literature, while aligning itself to a spectrum of radical political subcultures – a place to take a position against mainstream, conservative, consumerist, ‘normie’ values.

Yet contemporary art has, unlike many other subcultures, also developed an often-contradictory relationship with the oligarchical rich, and with the exclusivity and elitism that comes with it. One of the paradoxes of this is that while art has tended to align itself against mass and populist culture, it is a ‘subculture’ that has nevertheless become the culture of the elite. In recent years, the artworld’s otherwise privileged institutional world has taken to heart issues of social justice and environmental and ethical responsibility that characterise ‘progressive’ culture – a position that often pits it against the interests and values of the less-privileged sections of mainstream society, from the ‘squeezed middle’, disenfranchised working-class voters and others whose cultural perspectives differ sharply from these preoccupations.

This is not irrelevant to artworld resentments towards NFT ‘culture’. In his downbeat assessment of why the artworld should not invest too much (financially or culturally) in the lure of NFTs, Artnet’s Tim Schneider finds fault over issues of diversity and inequality; the ‘crypto-wealthy’ are ‘predominantly white and male’, chides Schneider, quoting one female artist who suggests that NFTs show ‘us in real time what disaffected white bros trafficking in meme culture looks like’; for good measure, Schneider scolds the ecological impacts of blockchain, since ‘the vast majority of existing [NFT] platforms run on the Ethereum blockchain, which by some estimates now matches the annual energy burn of Ecuador’.

‘White bro’ culture, carbon emissions, popular art and populist tropes – these land awkwardly with a contemporary artworld that now tends to gravitate towards progressive politics and minoritarian culture, and has developed an institutional distrust of anything popular or populist. But by complete accident, the NFT has produced a space in which subcultural forms of visual mass-culture can be monetised by the ‘little’ people. What really seems to disconcert ‘our’ current artworld is the sense that a form of largely unregulated, DIY mass culture has spawned beyond the reach or control of cultural gatekeepers. While blockchain frameworks might herald equality and decentralisation – and allowing marginalised groups to reclaim control of their own cultural economies – they can easily go the other way. The opportunity to access an easy-to-work form of art-object certification and a platform for primary and secondary market sales is too good for the art market to resist. And while this might threaten established market players and institutions, this might also do nothing more than transfer power to a different group of monied interests and influencers. One should be under no illusion that while commercial NFT platforms may have been taken up by individual creatives, these high-profile sales are being talked up by those pushing for the adoption of cryptocurrency as an alternative to the old system of fiat money.

The artworld’s love–hate response to the craze for NFTs only properly makes sense if a wider economic background is acknowledged, since at its heart lies the artworld’s disavowal of its own complicity in the orgy of financial liquidity that has characterised the decade since the financial crisis of 2008 – the period which, even then, saw huge art sales at auction – and that has now reached a critical point in the wake of COVID-19. According to the UBS Global Art Market report, art sales rose from $57 billion in 2010 to $64.1bn in 2019. Many commentators have noted the effects of ‘quantitative easing’ (QE) policies in propping up the fortunes of the stock market and the superrich; as the banks printed money to shore up economies after the crash, that money has gone into asset bubbles while real economies have stagnated. But by the mid-2000s, a phenomenon was emerging that took as its target the apparently unstoppable devaluation of fiat currencies that is the hallmark of QE. That phenomenon was cryptocurrency.

Writing for ArtReview in 2017 about the relationship between the concentration of value in the top end of the art market, I noted that there was more money chasing fewer objects. ‘In those circumstances,’ I suggested, ‘liquidity may start to flow elsewhere, into even more exotic forms of assets, as demand for other older assets grows and their prices rise. One of those seems to be cryptocurrency… the first cryptocurrency, bitcoin, has seen a massive rise in its market value. At the start of 2017 it was trading around $750. In October its price soared to over $5,000. Investment funds are piling in.’

As I write now, bitcoin is trading around $56,000, after a meteoric rise during 2020. Meanwhile, Ether, the cryptocurrency of the Etherium blockchain that mostly underpins NFTs, has also exploded in value. Starting 2020 at $132, it is now trading at around $1,750, the largest part of that rise occurring since mid-December, or around the time of Beeple’s high-profile auction on Nifty.

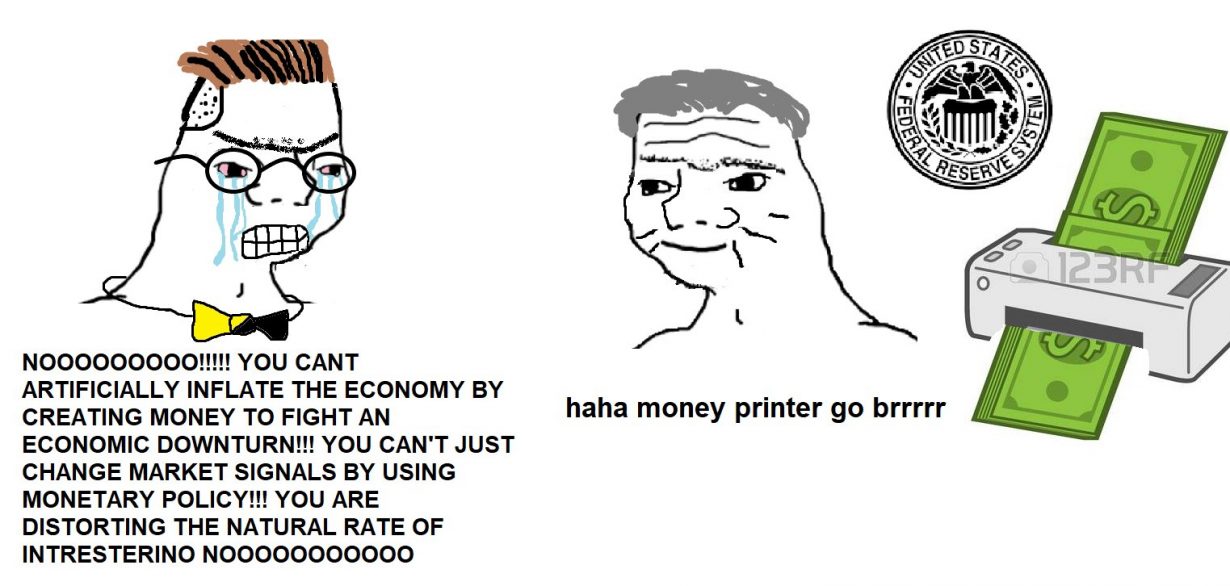

A popular internet meme of 2020 features an outraged bowtied figure who insists to another figure (representing the US Federal Reserve) that he can’t just ‘artificially inflate the economy by creating money’. To which the Fed character, next to a printer busily printing dollars, grins ‘haha, money printer go brrrrr’. Billions have been minted by central banks to support the incomes of people suffering the economic effects of the lockdown response to COVID-19. But printing money means that interest rates for fiat currency are effectively zero. In those circumstances, it’s not hard to see the attraction of moving fiat currency into cryptocurrency, or flipping virtual artworks that might increase rapidly in value, as Beeple’s CROSSROADS did in February, when it was resold for $6.6m, from an original sale of $66.6k. Cryptocurrency, NFTs and visual art have, without the artworld quite grasping it, combined at a moment when fiat currency has, in essence, become worthless, wages are dead and there is no reason for most people to save for a future that seems utterly without promise.

This makes 2020 the year of COVID-19, the year of cryptocurrency and the year of a popularised, mass-cultural form of the scarcity-based art market. Art’s commercial market has always been based on a mixture of real scarcity and contractually manufactured scarcity, jealously guarded by a complicated structure of institutional and cultural arbiters. COVID-19, meanwhile, has accelerated the trend towards the virtualisation of cultural goods, while monetisation – making a living – has become a pressing preoccupation for increasingly unemployed artists and creatives everywhere. The market for NFTs threatens to dislocate the spectacular fusion of elite interest and mass-cultural visibility that the artworld has come to take for granted.

The emergence of NFTs is a tale of late capitalism. A moment in which material prosperity and security for most people has dissolved, in a system that, unable to meet people’s needs, has dematerialised value. The cultural imaginary of this world is made of images of catastrophe. While Beeple may play up something of the ‘disaffected white bro’ (Beeple’s online ‘disclaimer’ to his work reads, ‘Most of my work is complete fucking garbage, but this old shit is reallllllly fucking bad’), the Beeple imaginary is analogous to the disaffections and ethical commitments of mainstream liberal culture: EVERYDAYS from 2020 include grotesque satires of Donald Trump (Shut this MF Up, 2 November), among paeans to Black Lives Matter (Endless Memorials, 3 June), LGBT rights (Progress, 15 June) and mockeries of middle-class white racism (Karen Attack, 18 June). What dominates, though, are dystopian visions of consumerist excess (Vibe City, 11 October) and ecological disaster (Fuck Earth, 12 June). LATE CAPITALISM (23 March) depicts a deer wandering among the ransacked shelves of an abandoned convenience store. It is the image of a future without people. For her part, Grimes’s series WarNymph features imploded hallucinations mixing baroque, medievalism and techno-futurism, centred on a winged cherub. WarNymph, in Nifty’s curatorial blurb, ‘explores the fluidity of identity in the virtual age: the ability to create, augment, and splinter ourselves into unlimited avatars, create boundless worlds, and build rich, complex lore’. Grimes, of course, is contributing a percentage of sales to Carbon 180, an NGO working to reduce carbon emissions.

By now, much contemporary art shares with much meme culture this apocalyptic-utopian vision of eco-disaster and a fragmented, posthuman subjectivity. These are little more than dreams to comfort a culture that can, in reality, see no future for itself. So, inasmuch as there is little in this more mass-cultural imaginary for contemporary art to disagree with, the question becomes what, if anything, might distinguish the artworld from this bigger culture of celebrity, virtual money and fantasies of an end to all this. Maybe little does. In which case, maybe it will soon dissolve, or turn into something else.